Lots of smart people expect Greece to default and leave the European Monetary Union. Global investors are not among them.

Even before Greece reached its bailout deal with European creditors this month, few investors thought Greece would exit the euro zone. Despite continuing turmoil, they still don’t. Why not? Because the market has confidence in the benefits bestowed by the common currency — and even more confidence that Greeks view things the same way.

You can see it in the price of Greek bonds. If investors thought default was likely, the bonds would get cheaper. What’s happened is the opposite. Anyone who bought Greek debt when the euro exit choir was loudest and sold it today has done well. Since April 20, Greek government bonds returned 18.5 percent — the only positive return of any euro-zone country, according to the Bloomberg Eurozone Sovereign Bond Index.

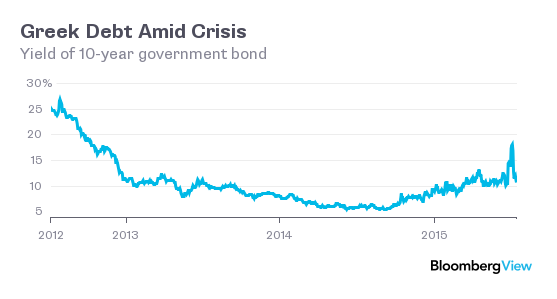

That’s the short-term picture. For a longer perspective, look at interest rates on the 10-year Greek bond, the benchmark of the country’s debt. They’ve come steadily down from a historical high in 2012 of 30.6 percent to 10.8 percent now. This too would never have happened if investors thought default or a euro exit was likely.

It’s fair to ask: How could anybody be optimistic about the economic prospects of a country with 26 percent unemployment, the worst perception of creditworthiness in the world (based on credit default swap prices) and a debt load equal to 175 percent of the country’s GDP?

One reason is faith in the euro.

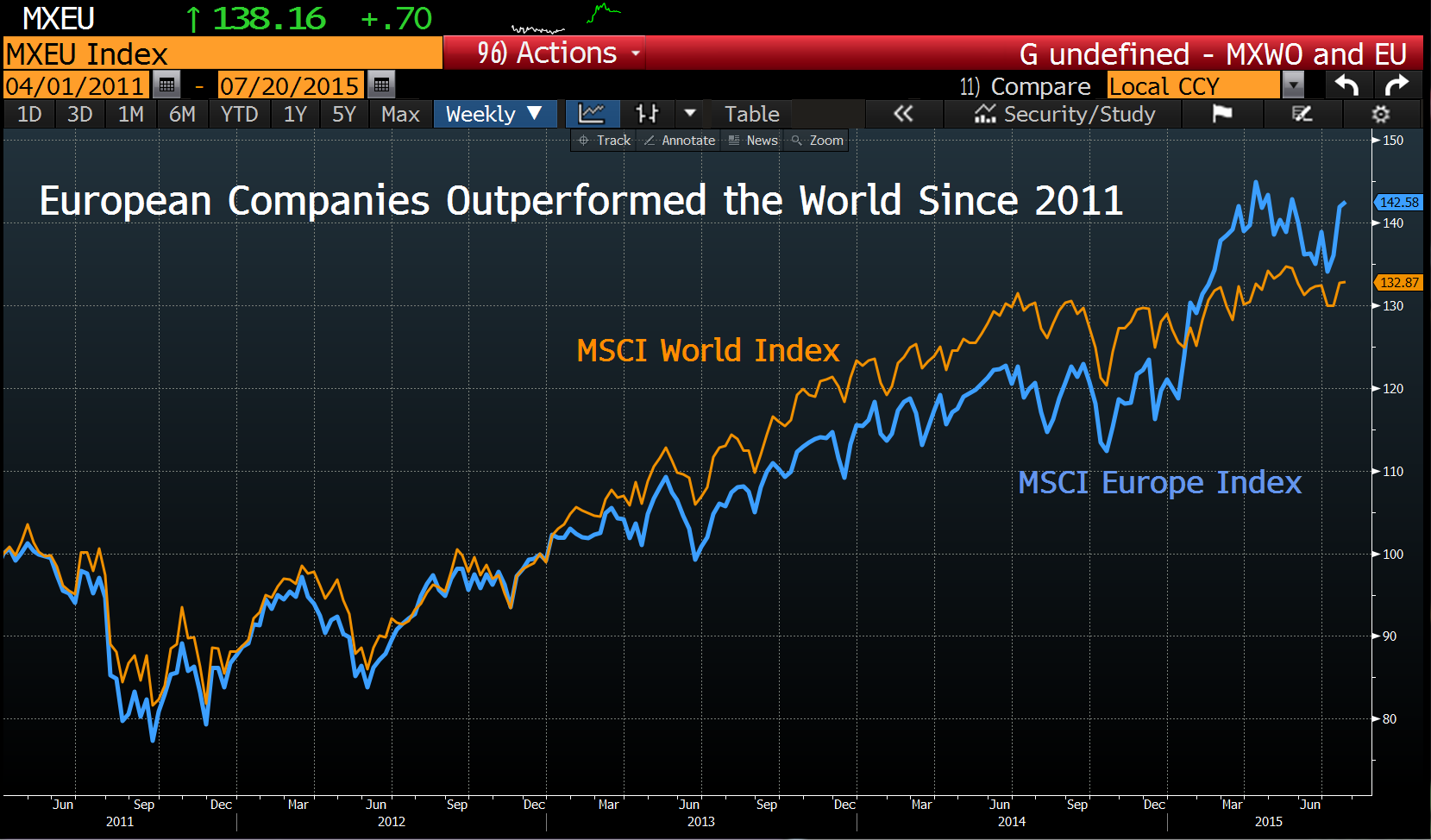

Remember 2011? When soaring yields on euro-denominated debt and depressed stock markets revealed widespread anxiety that the European Union would unravel with serial defaults of Spain, Portugal, Ireland and Greece? Since then global investors have embraced everything denominated in euros. The bonds and stocks of Greece are no exception.

Europe has become brighter during the past four years. The yield on bonds of European governments declined to 0.92 percent from 4.68 percent, according to the Bloomberg Eurozone Sovereign Bond Index.

Stocks of the 442 companies that make up the MSCI Europe Index appreciated 43 percent since April 2011 and 19 percent so far this year, beating the rest of the world.

Those are bets on the power of the euro to boost struggling economies. Take the example of Spain, which in 2011 was perceived to be the biggest threat to EU stability, dwarfing the Greek peril. Spain now is the fastest-growing among Europe’s major economies after five years of shrinking gross domestic product starting in 2009. Spain grew 1.4 percent last year, and its economy is expected to expand in 2015, 2016 and 2017, according to economists surveyed by Bloomberg.

Even Spain’s banks are flourishing after struggles that made them a symbol of European financial weakness during the financial crisis. Banco Santander and Banco Bilbao Vizcaya Argentaria are among only four of the 20 largest banks in the world that managed to see increased profitability during the past 20 years.

While Europe was returning to health and investors increasingly made euro assets their preference, gold declined more than 40 percent from its September 2011 high. Investors typically turn to gold when they expect financial turmoil. Not this time. The gold price didn’t rebound as anxiety over Greece increased this year.

Sure, Greece is a debtor nation with a disastrous economy and reform-resistant government. Yet its bonds this year remain well above the 34 cents on the euro price and well below the 30 percent yield of April 2012, and Greece has yet to trade at a discount comparable to New York City during the 1970s fiscal crisis or Chrysler in the 1990s.

The market says the euro means everything to Greece, which is why Greek debt has caught the eye of investors who get rich by betting on turnarounds. Take Richard Perry, who runs the $10 billion Perry Capital hedge fund. It purchased distressed Greek assets in anticipation that a deal would be struck. Now Perry thinks the best is yet to come. He says he expects to double his money on Greece before the decade is done.

By

By