By Christos Ziotis, Nikos Chrysoloras, Rebecca Christie, Bloomberg

By Christos Ziotis, Nikos Chrysoloras, Rebecca Christie, Bloomberg

Greek banks are being told by auditors some of their assets are overvalued, meaning they may have to raise close to the maximum 25 billion euros ($28 billion) allocated for their recapitalization this fall, people familiar with the matter said.

While a so-called Asset Quality Review on their books under the auspices of the European Central Bank is still in progress and no precise figures have been communicated yet, a drive by regulators to adopt more conservative assumptions about impairments and provisions for losses may lead to the capital holes, according to the three people, who asked not to be identified because the process is private.

A significant shortfall could also force Greek banks to sell assets, or scale down non-core activities, in order to raise capital, before tapping taxpayers’ money, and thus revise the restructuring plans approved last year by the European Commission.

An assessment “led by the Single Supervisory Mechanism is currently ongoing, and the Commission cannot at this stage prejudge if amendments to the restructuring plans will be required,” said Ricardo Cardoso, a spokesman for the European Commission. “We are in close and constructive contacts with the Greek authorities and the banks concerned.”

Bailout Allocation

The latest Greek bailout package allocates as much as 25 billion euros for National Bank of Greece SA, Piraeus Bank SA, Eurobank Ergasias SA and Alpha Bank AE. The higher the capital increase the banks need, the bigger the hit to existing shareholders. It would also add to Greece’s debt burden because more taxpayer money from the bailout would have to be used.

“There’s a difficult trade-off to manage for the ECB between being overly optimistic and overly pessimistic,” said Nicolas Veron, senior economist specializing in financial services at Bruegel in Brussels. “It’s important the ECB not get too conservative in its estimate, it would not be in public interest.”

Both Germany and Greece’s creditor institutions — the International Monetary Fund, the EU Commission and the ECB– want this assessment to be reliable, a German government official said. The outcome of the asset quality review will largely depend on the valuation of Greek government bonds and guarantees lenders have on their loans, according to the official, who asked not to be named as he wasn’t authorized to speak publicly on the matter.

Spokespeople for the Greek banks, the ECB and the Bank of Greece declined to comment.

Wilbur Ross

U.S. billionaire investor Wilbur Ross said in an interview last week that the review of Greek lenders’ capital needs by the ECB is too conservative and may result in an unnecessary burden for European taxpayers. His investment firm joined other investors in injecting 1.3 billion euros into Athens-based Eurobank last year. Should the banks have to issue more stock, their stakes would be diluted.

The ECB will communicate the results of its so-called Comprehensive Assessment of Greek lenders’ books around the end of October as part of the country’s bailout agreement. The exercise consists of a review of the quality of assets, including loan books. The findings will then be “stressed” under different economic assumptions.

One of the people familiar said that the ECB is wary of possible legal action against it from shareholders if the economic scenarios are seen as unreasonably pessimistic. The country’s economy unexpectedly grew by 0.9 percent in the second quarter of this year, compared with the previous quarter.

The audit is being focused on identifying holes in the valuation of existing assets, rather than potential losses under a stressed scenario, a second person said, adding that the ECB and the Single Supervisory Mechanism want an injection of money that would restore confidence among depositors and allow the Frankfurt-based institution to recover much of the Emergency Liquidity Assistance it has extended to Greek lenders.

Financing Hole

Greek newspaper Kathimerini reported on Wednesday that the final hole in the banks’ finances will probably be about 20 billion euros. Prime Minister Alexis Tsipras said in an interview with state broadcaster ERT in July that banks may need about 15 billion euros out of the total 25 billion euros allocated in the bailout. A Greek central bank official said that the review is ongoing, there’s no conclusion on potential shortfalls yet and any talk about figures is speculative. The official asked not to be named, in line with policy.

Greece’s four biggest banks are “sort of better than one would believe, the crisis taken into consideration, because they were all restructured,” EU Competition Commissioner Margrethe Vestager told reporters in Brussels on Wednesday.

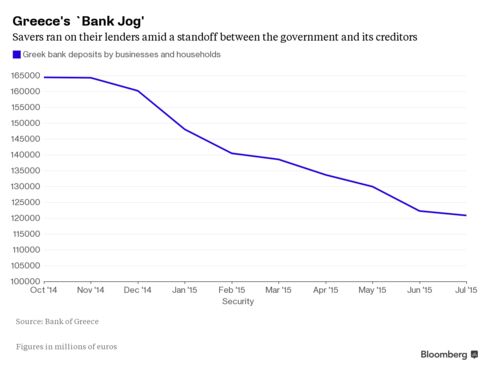

Greek banks have bled more than 43 billion euros in deposits over the previous year, amid a clash between the anti-austerity government of Alexis Tsipras and euro area member states. It left Greek lenders reliant on almost 90 billion euros of Emergency Liquidity Assistance extended by the Bank of Greece, subject to approval by the ECB. Capital controls still remain in place to stem withdrawals.

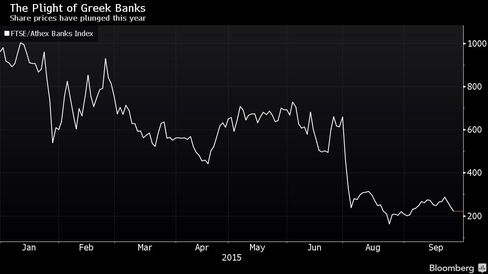

Shares in Greek banks meanwhile have lost about 77 percent of their value since the beginning of the year, amid speculation that the damage will inflict more losses on their shareholders after two rounds of capital increases in 2013 and 2014. Bank stocks were down 2.2 percent at 4:40 p.m. local time in Athens on Thursday, on track for a fourth consecutive day of losses.

“I’m very worried about the scenario in which ill-advised conservatism in the loan assessment process would end up in, one way or another, the oligarchs being able to have their loans written off,” Bruegel’s Veron said.